How Japan's Demographics Are Shaping its Future

Countries across the world invest heavily to harvest their demographic dividend. Japan however struggles with a negative birth rate. The EconInsider with Vihaan Kulkarni and Sualiha Khan investigate.

Japan’s Ageing Problem

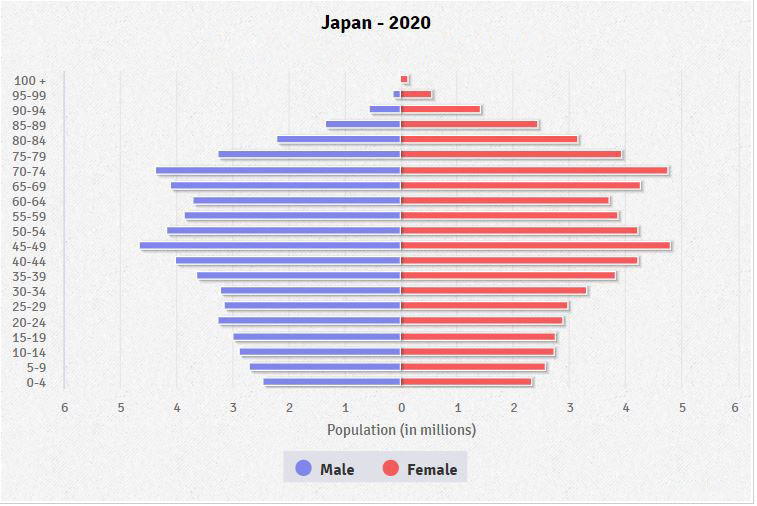

Japan is the G7 country with the oldest population demographic. More than one in every ten Japanese people are now 80 or older. According to national data, nearly one-third of the population is over the age of 65, with an estimated 36.23 million. 29.8% of Japan's population is 65 and older.

What are the causes of this gray tsunami which has engulfed Japan and how will it affect its social, political and economic growth?

Fertility & Society

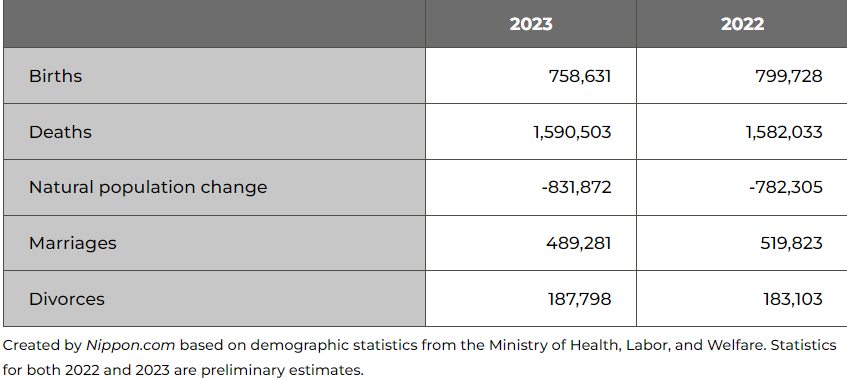

In 2023, Japan's total fertility rate dropped to a new low of 1.2, with Tokyo suffering the most, falling to 0.99. This number has been declining for the past eight years, with Japan recording 758,631 births (down 41,097 from last year). Since 1899, the number of births has been below 800,000 in 2022, and it has now fallen even lower. Marriages decreased by 6.0% compared to the previous year.

The reason for this could be that Japan’s culture lays importance on having a single breadwinner for the family - usually the man. With the dwindling global headwinds accompanied by a slimming in the job opportunities in Japan, most households are leaning away from having children, worried they’ll be unable to afford them. To this, Japan's Prime Minister, Fumio Kishida, said "Japan is on the verge of whether we can continue to function as a society." In 2020, researchers predicted that Japan's population would fall from 128 million in 2017 to less than 53 million by 2100. A lack of job opportunities, high living costs that outstrip salaries, and other factors all contribute to Japan's low fertility rate.

Global Life Expectancy

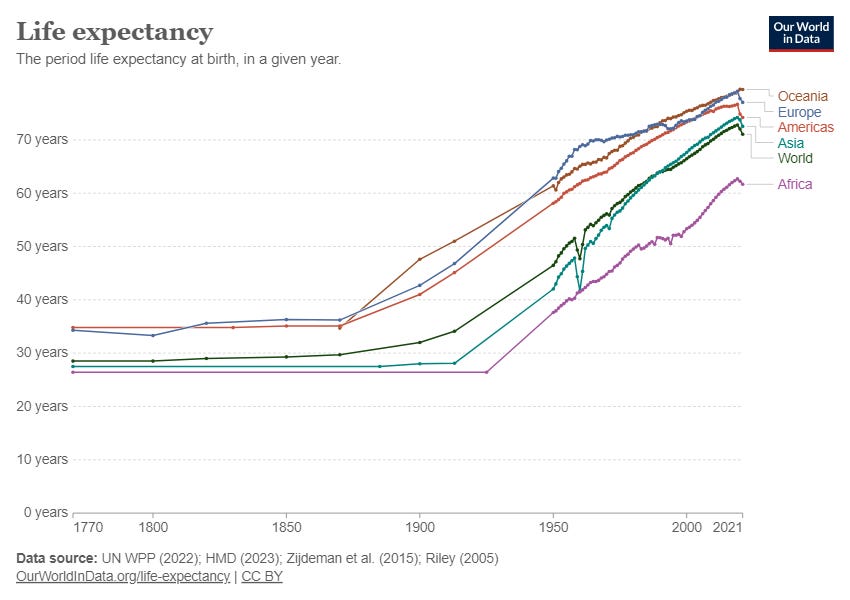

The dramatic increase in life expectancy over the last century has been a significant achievement, with the United Nations predicting that the number of people over 65 will double by 2050. However, individuals, businesses, and governments face challenges as a result of insufficient longevity support. In 2021, China's population fell by 850,000, marking its first negative growth rate.

Japan's Life Expectancy Increase

• 3.34 years from 81.1 years in 2000.

• Advances in health, nutrition, sanitation, and clean water.

• Impacts economies, societies, policies.

Effects on Economies, Health-Care and Long-Term Care Cost

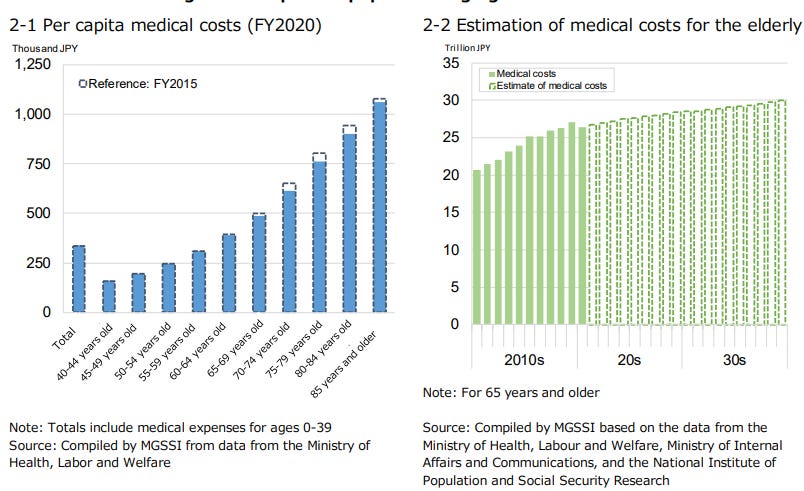

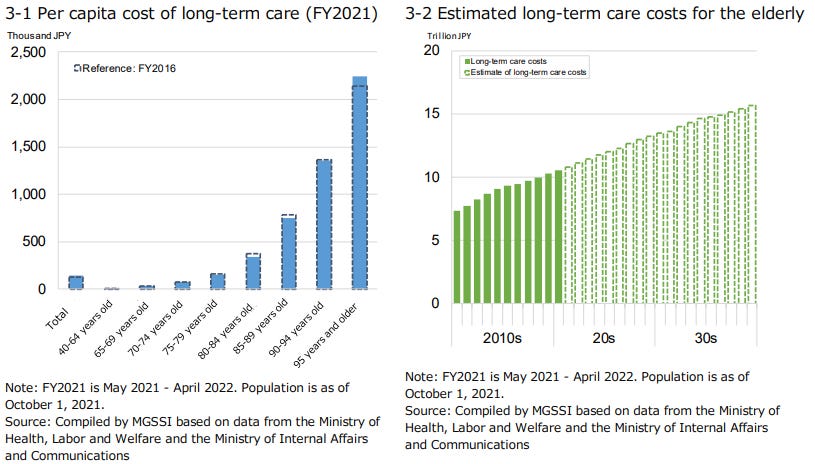

The per capita loss in the 65-69 age group was 490,000 yen, while the 85 and over group experienced ¥490,000. This represents over 1 million yen. As the population ages, medical costs are expected to rise, with the total cost of rehabilitation for the elderly rising from 26.4 trillion yen in 2020 to 28.5 trillion yen in 2030.

End-of-Life Care Expenditure Statistics for 2021

• The average long-term care cost per person is 140,000 yen.

• The elderly pay 300,000 yen.

• Elderly care costs are expected to increase from ¥10.5 trillion in 2020 to ¥13.4 trillion in 2030.

Japan's public finances, such as healthcare and pensions, are growing while the tax base declines. Low interest rates are highly correlated with population trends. The aging population prioritizes financial security over investment prospects, resulting in low interest rates and decreased profitability for financial institutions. Japan's population is rapidly shrinking, leaving empty dwellings due to overstock and falling property costs, particularly in rural areas. Higher percentages of the aging population, as well as migration of younger people to cities, hasten population decline and have an impact on housing costs. The decline in housing values poses substantial threats to the financial soundness of Japanese households and institutions. As Japan's demographics decline, the country's financial industry becomes more susceptible.

Japan's public finances, such as healthcare and pensions, are growing while the tax base declines. Low interest rates are highly correlated with population trends. The aging population prioritizes financial security over investment prospects, resulting in low interest rates and decreased profitability for financial institutions. Japan's population is rapidly shrinking, leaving empty dwellings due to overstock and falling property costs, particularly in rural areas. Higher percentages of the aging population, as well as migration of younger people to cities, hasten population decline and have an impact on housing costs. The decline in housing values poses substantial threats to the financial soundness of Japanese households and institutions. As Japan's demographics decline, the country's financial industry becomes more susceptible.

Fiscal Policies

To ensure fiscal stability while also maintaining supportive near term stimulus. In the case of Japan, this could mean targeted support of regions experiencing population decline, such as rural areas. This includes measures such as property tax relief, incentives for renovation, and affordable housing programs. By tailoring help, we can address the housing market challenges efficiently.

Monetary Policies

Aging affects the NRI (Natural Rate of Interest), which is the real interest rate consistent with stable inflation and full employment. Longer life expectancy leads to increased asset accumulation before retirement therefore capital becomes relatively abundant due to a declining working population. So, the Bank of Japan (BoJ) should maintain low interest rates to support growth and manage inflation. This accommodative stance encourages borrowing and investment, benefiting the economy.

Structural Reforms

Japan’s structural policy reforms to address demographic challenges include labour-market improvements, boosting the labour force (especially women and older workers), deregulation, and promoting investment. Implementing these reforms could offset up to 60% of the predicted growth slowdown. Automation also plays a key role in mitigating challenges posed by an ageing and shrinking population, particularly in healthcare, transportation, infrastructure, and fintech.

Conclusions

‘The Demographic Diaspora’ has been the biggest accelerator of decline in consumer spending. Japan’s economy has struggled since the first half of 2023 as Real Gross Domestic Product fell by 0.5% in the first quarter of 2024 from the previous quarter. By trusting Abenomics, Japan would be able to fight back against the tectonic shift in its societal & work culture. In summary, Japan’s demographic shift poses both challenges and opportunities, which requires innovative solutions to sustain its economy and workforce in the face of the ‘Gray Tsunami’.